Construction Industry Scheme (CIS) VAT Domestic Reverse Charge has started this month

Table of Contents

Why is it being introduced?

The domestic reverse charge VAT procedure is an anti-fraud measure designed to counter sophisticated criminal attacks on the UK VAT system. It intends to cut down on “missing trader” fraud, where companies receive high net amounts of VAT from their customers but have no intention of paying the VAT to HMRC.

What is the domestic reverse charge VAT?

Domestic reverse charge VAT legislation (DRC) is a change in the way CIS registered construction businesses handle and pay VAT. It is being introduced in the UK on 1 March 2021, having previously been delayed from October 2019.

If you are CIS Registered and you provide services to a CIS Registered business you will need to change the way you invoice them for your goods and services.

- Instead of invoicing your CIS Registered client for the services plus the cost of VAT you will need to indicate on your invoice that you have applied CIS Reverse Charging on the invoice and just the total of goods and services excluding VAT will be invoiced to your CIS Registered customer.

- Your CIS Registered Customer will pay you the amount of services excluding VAT and they (the customer) will pay the VAT to HMRC.

- This means that you will not have to pay VAT to HMRC on Invoices raised for CIS Registered Customers and the onus ids the CIS Registered customer to pay the VAT to HMRC.

- Because previously you would have been paid by your CIS Registered customer for the services you have invoiced them plus VAT you may experience a short term drop in cash flow.

- Upon filing your VAT Return you will pay less VAT to HMRC than you would have previously done prior to the change and in some circumstances, you may receive VAT Refunds from HMRC.

Who will it affect?

It affects VAT registered construction businesses that supply or receive construction and building services that are reported under the Construction Industry Scheme (CIS). It means the customer (contractor) will be responsible for the VAT due to HMRC instead of the supplier (subcontractor).

How to Prepare

To prepare for the Domestic reverse charge VAT Legislation we would recommend establishing a list of which are your CIS Registered customers to whom you will need to apply this change too.

When to Apply the Domestic reverse charge VAT legislation (DRC)

You should only apply the new Domestic reverse charge VAT legislation to customers whom all the following apply: –

- CIS Registered

- VAT Registered

- Payment for the supply of services you provide them is reported in the CIS Scheme even if you are registered for Gross Payment Status

- If the customer has not given you written notice that they are the end-user of the services you provide them with (for instance if you are a builder working on the offices belonging to your contractor, the customer is then the end-user and needs to give you written notification not to apply the VAT Reverse Charge).

- If you believe your CIS Registered Customer is an end-user it is advisable to contact them to check and to ask for written notification of their end-user status.

From 1st March 2021, you will need to apply the Domestic reverse charge VAT legislation to invoices you raise for building and construction services for your CIS Registered Customers under the above circumstances.

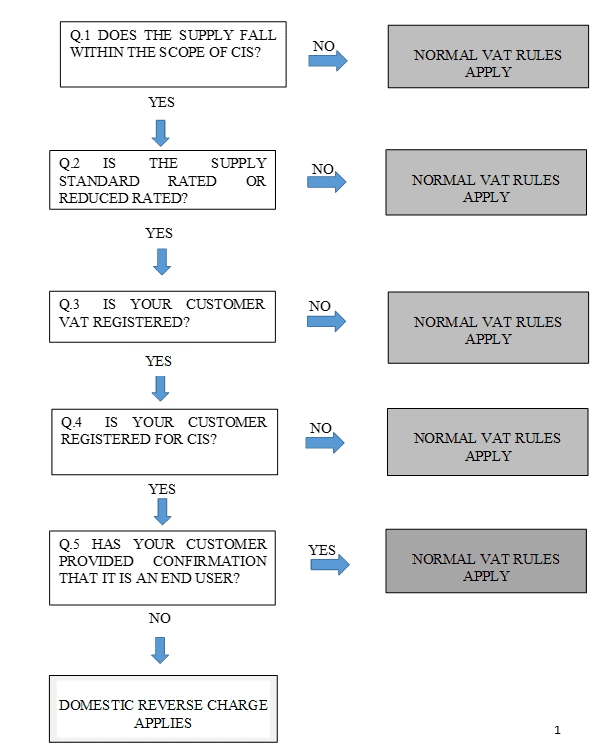

One the next page is a flowchart design to assist you in deciding which invoices require the VAT reverse charge applied. If you have any questions about whether a specific invoice should have the reverse charge applied please do not hesitate to contact us.

How to Apply the Domestic reverse charge VAT legislation (DRC)

QuickBooks

At the moment QuickBooks Online are finalizing the Software updates for The Domestic Reverse Charge VAT Legislation which will be in place for 1st March and we shall inform you of the VAT Codes to use as soon as they become available and we shall update you on the circumstances for applying each VAT code once the update is complete.

Xero

We will be setting up your VAT Reverse Charge codes and we shall be in touch with these codes and in what circumstances to use them once this is complete.

Other Software

If you create your sales invoices on other accounting software you will need to contact your software provider to ensure that it will be compliant with the Domestic reverse charge VAT legislation.

Period of Grace

In its guidance, HMRC says that it will “apply a light touch in dealing with related errors that occur in the first six months of the new legislation, as long as you are trying to comply with the new legislation and have acted in good faith”. This means that HMRC will not apply penalties on VAT Reverse Charges errors until at least 1st October 2021 provide there has been no deliberate attempt to mislead or defraud HMRC.

Further Assistance

If you have any queries about the Domestic reverse charge VAT please do not hesitate to contact us and we will be glad to assist you.

We will also keep you up-to-date with any other changes in VAT or other taxation policy.