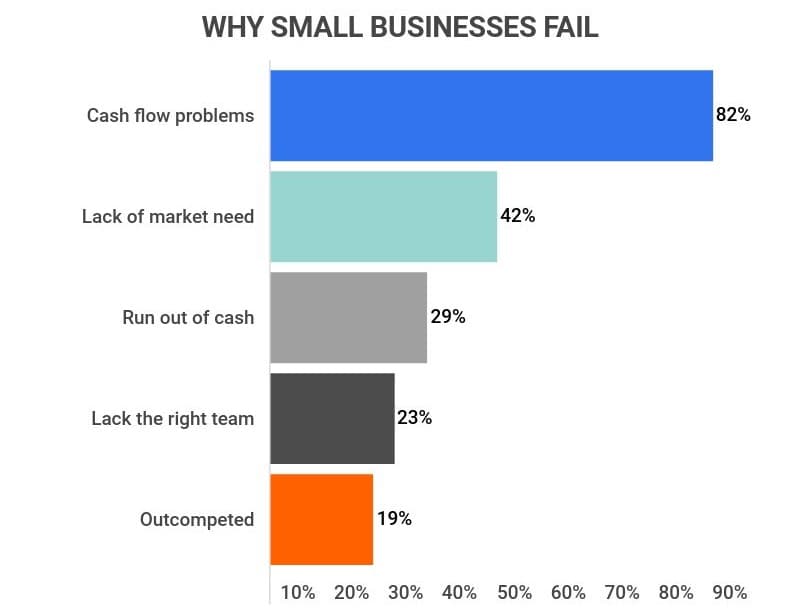

Did you know that 82% of businesses fail due to cash flow problems?

Understanding cash flow is crucial for the financial stability and success

of any business. In this article i hope to help business owners and aspiring

entrepreneurs with managing finances and optimising cash flow.

Key Takeaways:

- Cash flow, the money in and out, is key to business survival.

- Cash flow statements reveal the company’s financial health in detail.

- Good cash flow management can strengthen business relationships.

- Frequent checks and smart strategies can maintain a healthy cash flow.

- Use the cash flow equation (Inflow – Outflow) to monitor financial performance.

Let’s explore what cash flow means.

In this section, we will explore the definition of cash flow and its various components. Understanding cash flow is integral to managing the financial health of a business. We should thoroughly explore the basics of inflows and outflows, analyse the notion of free cash flow, and break down the cash flow statement.

The Fundamentals of Inflows and Outflows

Cash flow refers to the movement of money into and out of a company. Inflows represent the money coming into the business, such as revenue from sales, loans, or investments. On the other hand, outflows are the expenses the business incurs, including costs of goods sold, operating expenses, and taxes.

To maintain a positive cash flow, it is crucial to have a healthy balance between inflows and outflows. A company must ensure that its revenues consistently exceed its expenses to avoid cash flow problems.

Understanding Free Cash Flow and its Importance

Free cash flow, which is the money left after paying all expenses, helps gauge a company’s financial health. If a company has positive free cash flow, it means they have extra cash that can be invested back into the business or given to shareholders. If it’s negative, they might need to reduce costs or seek external financing.

Dissecting the Cash Flow Statement

The cash flow statement is a financial statement that presents the inflows and outflows of cash during a specific period. It provides valuable insights into a company’s ability to generate cash, its liquidity, and the sources and uses of cash.

The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. The operating activities section captures the cash generated or used in day-to-day business operations. The investing activities section includes cash flows related to the acquisition or disposal of assets. Finally, the financing activities section includes cash flows from raising or repaying capital, like issuing or buying back shares, or taking on or repaying debt.

Cash flow statements help stakeholders evaluate the company’s ability to pay its debts and guide them in making investment or financing decisions.

Why Effective Cash Flow Management is a Cornerstone for Businesses

Effective cash flow management is key to business stability and success as it ensures financial stability, allows for growth, and helps manage challenges.

Essentially, it enables a business to maintain healthy liquidity, ensuring there are sufficient funds for daily expenses like rent and payroll.

By analysing cash flow trends, businesses can identify opportunities for better cash use and strategic resource planning, enabling smarter decisions about investments and expansion.

Regular monitoring helps spot potential issues early, such as falling sales or late payments, allowing for quick action to mitigate impact.

Lastly, clear understanding and communication of cash flow to stakeholders build trust and facilitate better financial dealings, aiding in securing financing and maintaining positive business relationships.

Breaking Down the Cash Flow Statement

The cash flow statement is an important financial statement for businesses. It provides a comprehensive overview of a company’s cash inflows and outflows during a specific period. By analysing the cash flow statement, businesses can gain valuable insights into their financial health and make informed decisions.

When examining the cash flow statement, it is essential to understand its format and how to conduct a proper analysis. Let’s break down the components of the cash flow statement and explore the process of analysing it.

The Threefold Categorisation of Cash Flow

The management of cash flow is essential for the financial health and success of a business. In order to effectively analyse and optimise cash flow, it is important to understand its categorisation. Cash flow can be classified into three main categories:

Cash Flows From Operations: The Engine of Your Business

Cash flows from operations refer to the cash generated or consumed by a company’s core business activities. These activities involve the production and sale of goods or services, which generate revenue and incur expenses. Examples of cash flows from operations include revenue from sales, payment of employee salaries, and payment to suppliers for raw materials.

Cash Flows From Investing: Fuelling Future Growth

Cash flows from investing relate to the cash generated or spent on investment activities. This category includes the buying and selling of assets such as property, plant, and equipment, as well as investments in other companies. Cash inflows from investing activities may come from the sale of assets, while cash outflows may occur when purchasing new assets or making investments.

Cash Flows From Financing: Backbone of Business Structure

Cash flows from financing represent the cash generated or used to finance a company’s operations and growth. This category includes activities such as raising funds through equity or debt, paying dividends to shareholders, or repurchasing company shares. Cash inflows from financing can come from issuing new shares or taking on new loans, while cash outflows may occur when repaying debt or paying dividends.

To make good financial decisions, it’s necessary to categorise cash flows correctly. By knowing the different cash flows types, companies can manage money better and boost their financial performance.

| Cash Flow Category | Definition | Examples |

| Cash Flows From Operations | Cash generated or consumed by core business activities | Revenue from sales, payment of salaries, payment to suppliers |

| Cash Flows From Investing | Cash generated or spent on investment activities | Sale of assets, purchase of new assets, investments in other companies |

| Cash Flows From Financing | Cash generated or used to finance operations and growth | Issuing new shares, taking on new loans, repayment of debt, payment of dividends |

What is Cash Flow: Real-World Examples to Illuminate the Concept

To further understand the concept of cash flow, let’s take a look at some real-world examples that illustrate how cash flow works in different business scenarios. These examples will provide practical insights into the importance and impact of cash flow in businesses of various sizes and industries.

Example 1: Retail Store

A retail store experiences consistent cash inflows from sales to customers. These inflows, which are part of the statement of cash flows, are generated from daily transactions, like purchases of products or services. However, the store also incurs various cash outflows, such as paying suppliers, employees’ salaries, and other operating expenses. Understanding the timing and magnitude of these cash inflows and outflows is crucial for managing the store’s cash flow effectively and ensuring its financial stability.

Example 2: Manufacturing Company

A manufacturing company typically has significant upfront expenses for raw materials, machinery, and other production-related costs. However, the actual cash inflows might be delayed, as it takes time to manufacture and sell the final products. This creates a potential cash flow gap, which can be managed by effective cash flow planning and financing options. By monitoring and optimising cash flow, the manufacturing company can ensure smooth operations and sustainable growth.

Example 3: Freelancer

A freelancer, such as a graphic designer or writer, relies on cash inflows from clients for their services. However, the timing of these inflows can vary, as clients may have different payment terms. The freelancer needs to carefully manage their cash flow to cover personal expenses, such as rent, utilities, and other necessities, during periods of lower cash inflows. By maintaining a steady cash flow, the freelancer can sustain their business and pursue growth opportunities.

These real-world examples demonstrate how businesses in different industries manage their cash flows to ensure financial stability and success. By analysing the inflows and outflows of cash, businesses can make informed decisions, plan for the future, and navigate various challenges effectively. Understanding these examples provides valuable insights into the importance of cash flow management and its impact on the overall financial health of businesses.

Dissecting the Mathematics Behind Cash Flow

In this section, we will dive deeper into the mathematical aspects of cash flow. Understanding the cash flow formula and analysing the dynamics of cash inflow and outflow are essential for effective financial management.

The Simplicity of the Cash Flow Formula

The cash flow formula is simple: Cash Flow = Cash Inflow – Cash Outflow

It’s all about subtracting the money spent (outflow) from the money received (inflow). This calculates a company’s net cash flow and gives an overview of its financial health

Analysing the Dynamics of Cash Inflow and Outflow

Once you get the cash flow formula, it’s important to study the cash coming in and going out. This can help businesses spot trends, risks, and how cash flow differs from profit. It aids in making decisions to improve cash flow.

An effective cash flow analysis involves:

- Identifying the main sources of cash inflow: This includes sales revenue, investments, loans, and any other cash-generating activities. Understanding the primary sources of income helps businesses forecast future cash inflows accurately.

- Evaluating the cash outflow: It is essential to categorise and analyse various expenses to identify areas where costs can be reduced or optimised. This includes monitoring operating expenses, loan payments, and discretionary spending.

- Assessing the timing of cash inflow and outflow: It’s important to know when cash comes in and out to manage working capital well. Businesses need to make sure they have enough cash to cover costs and keep running daily.

- Measuring cash flow against business objectives: Regularly comparing actual cash flow with projected cash flow helps businesses assess their financial performance. If the cash flow falls short of expectations, adjustments can be made to improve liquidity and profitability.

By closely analysing the dynamics of cash inflow and outflow, businesses can identify areas of improvement, make informed financial decisions, and ensure the long-term sustainability of their operations.

Strategies for Optimising Your Cash Flow

Improving cash flow is vital for business health. Here, I’ll provide tips for managing cash flow better.

- Forecast and Plan:

To optimize cash flow, you need good forecasting and planning. Use past data and market trends to predict future cash flow. This can help spot any potential issues ahead of time.

- Improve Receivables Management:

Implement effective accounts receivable management practices to ensure timely and full payment from customers. This may include offering incentives for early payment, establishing clear credit policies, and conducting regular credit assessments.

- Optimise Inventory:

Excess inventory ties up valuable working capital. Analyse your inventory levels and identify slow-moving or obsolete items. Implement inventory control measures to reduce carrying costs, such as just-in-time inventory management or implementing automated inventory systems.

- Negotiate with Suppliers:

Establish strong relationships with suppliers and negotiate favourable payment terms. This could include extending payment terms, securing discounts for early payment, or exploring alternative sourcing options to reduce costs.

- Monitor Cash Flow Regularly:

Track your cash inflows and outflows regularly to identify any patterns or trends. This will help you identify potential cash flow issues and take corrective actions. Utilise cash flow management tools and software to streamline the process.

- Control Expenses:

Review your expenses regularly and identify areas where costs can be reduced or eliminated. This may include renegotiating contracts with vendors, implementing energy-saving measures, or exploring cost-effective alternatives for business operations.

- Explore Financing Options:

If cash flow constraints persist, consider exploring financing options such as business loans, lines of credit, or invoice financing. However, evaluate the costs and terms associated with each option to ensure that they align with your long-term cash flow objectives.

Implementing these strategies will help you optimise your cash flow and ensure the financial stability and growth of your business.

FAQ

What is cash flow?

Cash flow refers to the movement of money in and out of a business over a specific period of time. It represents the inflow and outflow of cash from various activities such as sales, operating expenses, investments, and financing.

Why is cash flow important for businesses?

Cash flow is vital for businesses as it ensures they have enough funds to cover their expenses, invest in growth opportunities, and meet their financial obligations. It provides a clear picture of the financial health and sustainability of the business.

How is cash flow statement different from other financial statements?

While income statements and balance sheets focus on profitability and assets, the cash flow statement specifically tracks the movement of cash within a business. It provides a comprehensive view of cash inflows and outflows, allowing businesses to assess their liquidity and financial stability.

What are the components of the cash flow statement?

The cash flow statement consists of three main components: cash flows from operations, cash flows from investing, and cash flows from financing. These categories provide insight into the sources and uses of cash in a business.

How can businesses effectively manage their cash flow?

Effective cash flow management involves closely monitoring and forecasting cash inflows and outflows, maintaining a cash reserve, adopting proactive credit and collections practices, and optimising operational efficiency. It may also involve securing additional financing or adjusting business strategies to improve cash flow.

What are some examples of cash flow from operations?

Cash flow from operations includes cash received from customers, payments to suppliers and employees, taxes paid, and other operating-related expenses. It represents the daily operational activities that generate or utilise cash within a business.

How do you calculate cash flow?

The cash flow formula is simple: Cash flow equals cash inflows minus cash outflows. It provides a measure of the net change in cash during a specific period, indicating whether a business has a positive or negative cash flow.

What are some strategies for optimising cash flow?

Strategies for optimising cash flow include negotiating favourable payment terms with suppliers, incentivising early customer payments, reducing unnecessary expenses, closely monitoring inventory levels, and considering alternative financing options.