Changing from Sole Trader to Limited Company

If you're a sole trader, switching to a limited company can feel exciting but also a bit overwhelming. This change can help…

Autumn Budget 2024 Predictions

As the new parliament begins, the Chancellor has a prime opportunity to introduce significant tax changes. The Labour government has signalled that…

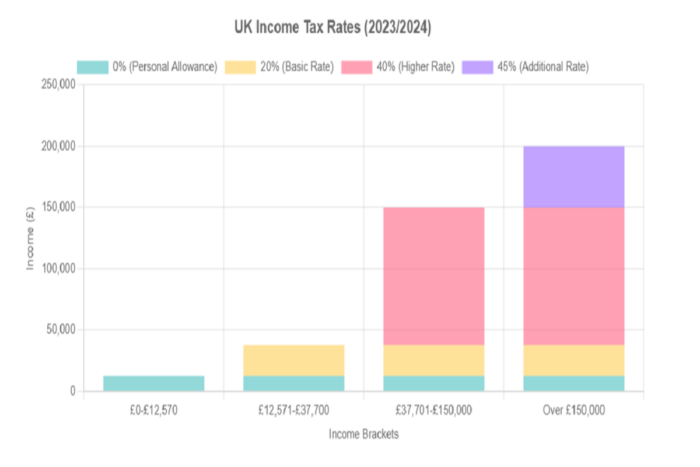

UK Tax Brackets: Understanding Your Income Rates

Did you know the personal allowance for the current UK tax year is £12,570? This amount plays a significant role in the…

Exploring Different Types of Personal Budgets

There are many ways to plan a budget. You can go classic with detailed spending lists or try something new like the…

Why do you need an Accountant for your business?

Are you thinking about hiring an accountant for your business, or switching because you just aren't getting the service your business requires?…

How to Manage the Finances of your Side Hustle

Having a side hustle is beginning to seem vital in today's world, especially for younger generations. With prices going up, many people…